Go Solar

![]() If you’re interested in investing in a solar electric photovoltaic, or PV system, you have options when deciding the type of system and how to finance it. It’s important to consider your particular situation when deciding which is best for you. Your goals, property characteristics, and level of financial commitment will determine which option will best suit your needs. Consider the following:

If you’re interested in investing in a solar electric photovoltaic, or PV system, you have options when deciding the type of system and how to finance it. It’s important to consider your particular situation when deciding which is best for you. Your goals, property characteristics, and level of financial commitment will determine which option will best suit your needs. Consider the following:

How much will it cost to purchase a system?

The cost of your system will depend on your average usage and how much of your usage you would like to cover. A federal tax credit is available to those whose tax liability is high enough to take advantage of it.

The first step is gathering information and performing a thorough and efficient site visit. This is absolutely critical to the success of solar projects, especially residential projects!

After we capture all of the necessary information, we will be able to quote a system for your consideration and begin design work on the project.

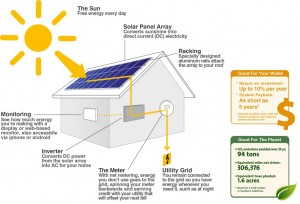

How does solar work?

Solar Electricity, or Photovoltaic (PV) is a process that converts sunlight into electricity. The more direct sunlight the PV modules receive the more electricity they produce. The PV modules are comprised of small photovoltaic cells that are all wired together and sealed between a plastic backing and a tempered glass cover. The solar modules create DC (direct current) power. This DC power is converted into standard AC (alternating current) power, allowing it to be fed directly into your home to offset your electric bill.

How does net metering work?

Net metering participants do not receive a check for the energy they produce. The benefits arrive in the form of avoided energy costs or a credit to the consumer’s electric bill. Solar credits can be used to offset the energy charges on your electric bill.

Is now a good time to go solar?

Is now a good time to go solar?

None of us can see into the future to determine exactly the right time to invest in solar. However, there are some known factors to consider.

First, the cost of solar has been steadily falling for years. This trend is expected to continue then eventually level off as prices fall as low as material and labor costs allow.

Second, the Federal Investment Tax Credit of 30% of the total system cost is available through 2019. After that, it will continue, but at a less generous level. You need to have a federal tax obligation of the amount of the credit or more to fully take advantage of this benefit.

Third, the cost of solar panels over their lifetime is fairly predictable and stable; the reliability of PV systems has been high and many panel manufactures offer 20-25 year product warrantees. Electric rates, on the other hand, are likely to increase. Investing in solar helps to hedge against future rate increases, but how much you’ll save depends on how much rates increase.

Finally, even with favorable conditions, solar should be viewed as a long-term investment in your energy future and weighed against other potential investments. In some cases there are home investments (eg, adding insulation, envelope improvements, more efficient HVAC equipment, lighting, appliances, and mode of transportation) that may achieve comparable savings in the long run, help reduce your environmental impact, and conserve energy.

What type of financing is best for me?

Now that you’ve decided which type of solar system is best for you, the next step is to decide whether to purchase or lease the system. Each approach has pros and

cons, and evaluating your individual needs, means, and goals will help determine which approach is best for you.

This approach might be a good option for you if…

- Own

- You want to maximize the financial return on your solar investment.

- Your tax liability exceeds the value of state and federal tax credits for solar.

- You are comfortable assuming responsibility for the maintenance of the system.*

- You are willing to pay the full cost upfront, either from savings or borrowing.

- You want a simple arrangement with clear ownership for the lifetime of the panels.

- You want to increase the value of your property.

- You would like a production guarantee. Some contractors guarantee credit for a certain amount of production regardless of how much energy the panels produce.*

- Rent

- The main reason you’re pursuing solar is not financial. Your total financial benefit will be significantly lower than if you purchased a system.

- Your tax liability is less than the value of state and federal tax credits for solar.

- You would rather have the solar installer perform necessary maintenance over the life of the contract.*

- You would prefer to have a smaller or no upfront payment.

- You are comfortable evaluating a contract that may have complex terms.

- You would like to have the option of getting new panels when the lease expires.

- You would like a production guarantee. Some contractors guarantee credit for a certain amount of production regardless of how much energy the panels produce.*

* In general, solar systems are durable and reliable and do not require much maintenance. However, they are subject to the influence of temperature and weather (including lightning and severe events), accidental breakage, and vandalism. Panel performance also degrades over time and should be considered in your purchase or lease.

What are the benefits of investing in solar?

The benefits to going solar are numerous and include:

- Saving the Environment

- Reducing Your Carbon Footprint

- Clean Power

- Reducing Fossil Fuel Usage

- Reducing Electrical Bill

- Green Lifestyle

- Property Appreciation

Solar Incentives

Federal, state and local government incentives significantly lower the cost for solar systems. It is important that you research and understand which incentives are available to you before purchasing your solar system, as these incentives will dramatically reduce your investment and increase your return on investment (ROI).

There are three main types of financial incentives for solar.

Federal Tax Credits

Currently, there is a 30% (of the solar system cost) investment tax credit (ITC), as well as other tax credits, offered by the federal government.

State and Local Rebate Programs

Different states, cities, and utility companies offer different rebate programs that support solar and cover part of your solar system cost. We recommend that before going solar you will find out which programs are offered in your area.

Renewable Energy Credits

Producers of solar energy are credited with one Renewable Energy Credit (REC) for every 1MWh of electricity produced with their solar system. These RECs can be sold to companies who need to meet renewable energy standards or goals.

DSIRE – The Most Updated Database of Incentives for Renewable Energy

Click here to find solar incentives near you!

Call us today to schedule a No Cost Consultation!